ad valorem property tax florida

These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. Ad Valorem Taxes Ad valorem is a Latin phrase meaning according to worth.

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Ad Valorem is a Latin phrase meaning According to the worth.

. Therefore if for whatever reason the property owner fails to receive a tax bill it is the property owners. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Florida Statutes provides a number of ad valorem property tax exemptions which will reduce the taxable value of a property.

The Tax Collector for Polk County is a proud member of the Florida Tax Collectors Association. Columbia County Property Appraiser 135 NE Hernando Ave. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

If you sell the vehicle without transferring the license plate to your new vehicle. Non-ad valorem assessments are also made on real property for essential services such as fire protection and garbage collection. Reduction of Ad Valorem Property Tax.

A tax certificate is an interest bearing lien for unpaid real estate and non-ad valorem assessments. Before they risk loss of the property. Florida property taxes are relatively unique because.

These are levied by the county municipalities and various taxing authorities in the county. Payments accepted in our offices by Cash Check Debit Card Visa MasterCard. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150.

Florida property taxes are relatively unique because. Ad Valorem taxes on real property is collected by The Tax Collectors office on an annual basis beginning November 1st for the year January through December. We are committed to meeting all legal requirements to our public business and government customers by collecting and distributing taxes license fees and information in a prompt and accurate manner while supporting a.

Copies of the non-ad valorem tax roll and summary report are due December 15. As stated in Florida Statute 197502 after the 2 year period has elapsed and taxes remain unpaid the certificate holder. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property.

According to Chapter 197122 Florida Statutes it is the taxpayers responsibility to ensure that hisher taxes are paid and that a tax. Ad Valorem Tax Exemption Application Return for Charitable Religious Scientific Literary Organizations Hospitals Nursing Homes and Homes for Special. It includes land building fixtures and improvements to the land.

11th Street Panama City FL 32401. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public service workers including teachers law enforcement officers emergency medical personnel active duty members of the military and Florida National Guard and child welfare service employees. Florida Statute 197374 allows for partial payments to be made on a current year tax for Real Estate or Tangible accounts.

First responder is defined to mean a law enforcement officer a correctional. A yes vote supported levying an ad valorem tax of 1 mill 1 for every 1000 of assessed value to pay schoolteachers and fund public and charter school programs. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Application for these exemptions must be made by. The most common real property exemption is the homestead exemption. 3 if paid in December.

Florida Statute 197374 allows for partial payments to be made on a current year tax for Real Estate or Tangible accounts. Suite 238 Lake City Florida 32055. The Florida Department of Highway Safety and Motor Vehicles requires you to surrender your license plate by mail or in person at a Tax Collectors Office in the following circumstances.

The Duval County Public Schools Florida Ad Valorem Tax Measure was on the ballot as a referral in Duval County Public Schools on August 23 2022. Ad Valorem taxes on real property are collected by the Tax Collector on. It was approved.

This exemption provides ad valorem tax relief equal to the total amount of ad valorem taxes owed on a homestead property of a Florida first responder who is totally and permanently disabled as a result of an injury or injuries sustained in the line of duty. In accordance with Florida Statute 194014 property owners who filed a 2021 petition challenging the assessment of their property before the Value Adjustment Board VAB were required to pay at least 75 percent of the petitioned propertys assessed ad valorem taxes taxes based on the assessed value of the property and 100 percent of the propertys assessed non-ad valorem. Most forms are provided in PDF and a fillable MSWord file.

Florida property tax homestead exemption reduces the value of a home for assessment of property taxes by 50000 so a home that was actually worth 100000 would be taxed as though it was worth only 50000. Ad valorem taxes are levied annually based on the value of real estate property and tangible personal property. They are a first lien against property and supersede governmental liens.

The tax roll describes each non-ad valorem assessment included on the property tax notice bill. The Great Depression began in 1929 and caused reforms in ad valorem. 4 if paid in November.

Real property is located in described geographic areas designated as parcels. 2 if paid in January. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

We are committed to serving all citizens of Santa Rosa County in the most courteous professional innovative and cost-effective manner. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem tax assessments. The Florida Department of Revenues Property Tax Oversight program provides commonly requested tax forms for downloading.

If you move to a new state and register the vehicle in that state. Box 2285 Panama City FL 32402 Physical Mailing Address. Ad Valorem Non Ad Valorem Tax Collection.

However the second 25000 of. Visit our Property Tax Alternative Payment Options page for information on the quarterly installment plan statutory partial payment plan and homestead tax deferral program. Discounts are extended for early payment.

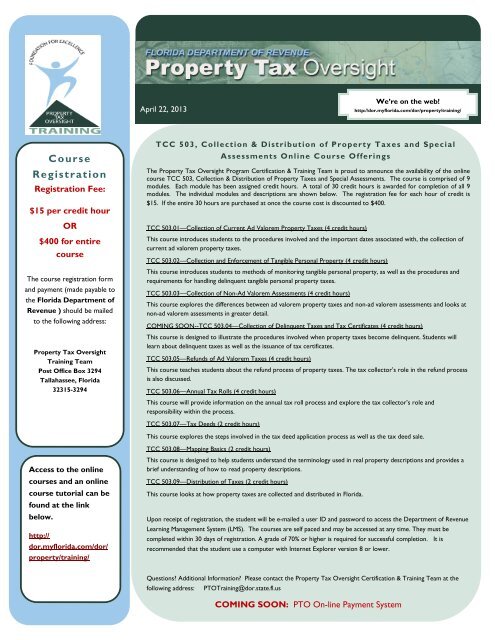

Tcc 503 Announcement Edited Florida Department Of Revenue

A Realtor Is Not A Salesperson They Re A Matchmaker They Introduce People To Homes Until They Fall In Love With On Wedding Planner Matchmaker Estate Lawyer

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

How Swfwmd Spends Its Share Of Your Tax Bill

Property Taxes Highlands County Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Millage Rates Walton County Property Appraiser

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Explaining The Tax Bill For Copb

Technology Marina Title Is A Florida Title Company Where Real Estate Professionals And Consumers Experience T Miami Realtor Real Estate Tips Miami Real Estate

Real Estate Property Tax Constitutional Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Broward County Property Taxes What You May Not Know

Members Of The Canadian Snowbird Association Look For Proposed Tax Notice From Pinellas County Snowbird Alert