extended child tax credit calculator

Please be aware that your children need to be under 18. Canada Dental Benefit - for some children under 12 who do not have access to a private dental insurance plan.

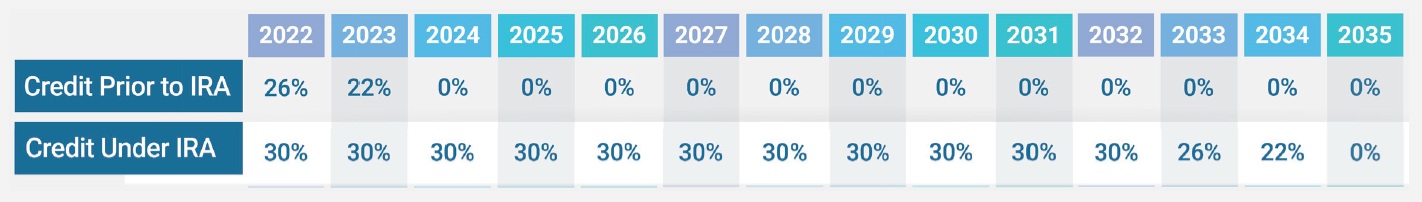

Solar Investment Tax Credit Itc Seia

To use it enter your income and.

. Dont get TurboCharged or TurboTaxed. What is the Earned Income Tax Credit. Filed a 2019 or 2020 tax return and claimed the Child Tax.

Already claiming Child Tax Credit. Use this handy expat tax calculator to estimate your refundable child tax credits. Start Child Tax Credit Calculator.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience. To be a qualifying. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US. Here is some important information to understand about this years Child Tax Credit. The 2021 Earned Income Tax Credit provides more money to more Americans Who is eligible for the 2021 Earned Income Tax Credit.

Child tax credit. Ending childhood hunger is a priority for the Biden administration. The Child Tax Credit provides money to support American families.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Child Tax Credit will not.

The enhanced child tax credit which was created as part. Did you know that your family could receive up to 3600 from the federal government for each of your children. In reality the administration has unveiled a comprehensive plan to combat hunger which includes.

Child Tax Credit and Earned Income Tax Credit Benefit Calculator. Enhanced credit could be extended through 2025 Its a much bigger credit for potential taxpayers in tax year 2021 its as high as 3600 per child ages 5 and. Enhanced credit could be extended through 2025.

150000 if married and filing a joint return or if filing as a qualifying widow or. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Child tax credit.

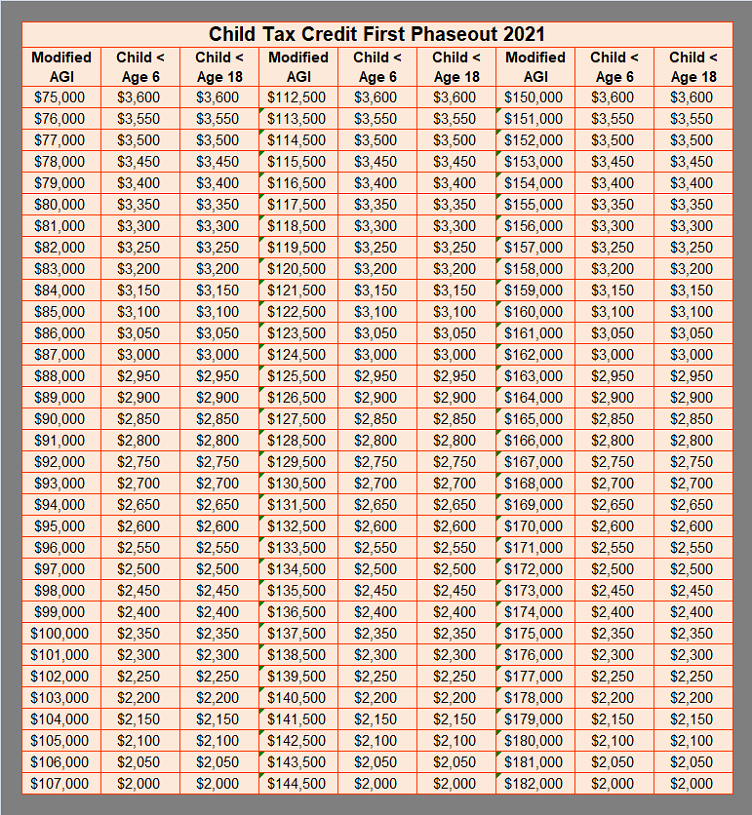

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The amount you can get depends on how many children youve got and whether youre. How much is the.

Making a new claim for Child Tax Credit. Its a much bigger credit for potential taxpayers in tax year 2021 its as high as 3600 per child ages five. Number of your children with age between 6 and 17 below 18 years old - you can receive up to 3000 for each one.

Extended child tax credit calculator Saturday July 30 2022 Edit. If youre looking to use these benefits and want to see how much money you might get back for a child try out the child tax credit calculator. The payments for the CCB young child supplement are not.

What Is The Child Tax Credit And How Much Of It Is Refundable

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Third Payment On Its Way To Millions Of Families Cnn Politics

Ready To Use Child Tax Credit Calculator 2021 Msofficegeek

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Earned Income Tax Credit Applies To Some Who Might Not Realize It

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit What S Changing In 2022 Northwestern Mutual